Is there a new 2021 w9 form?

As it was mentioned earlier, you can find the latest W-9 form 2021 fillable on the IRS website. Though, in most cases you'll get the blank from the requester. Note that some states may have form substitutes like the one in NY city. They'll look a bit different comparing to the conventional document.

How can I download my W9 form for free?

Commonly, the business or financial institutions will give you a blank W-9, and you can complete it directly. Or if you or your business is asked to provide a fillable w 9 form to independent contractors, you can download the w 9 form directly from the IRS website.

Can you download a w9 form?

The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

Can you print out a w9 form?

Send it via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Can you print out a W9 form?

Send it via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Is there an updated W9 form for 2021?

As it was mentioned earlier, you can find the latest W-9 form 2021 fillable on the IRS website. Though, in most cases you'll get the blank from the requester. Note that some states may have form substitutes like the one in NY city. They'll look a bit different comparing to the conventional document.

Can I print off a W 9 form?

Send it via email, link, or fax. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it, upload its image, or use your mobile device as a signature pad.

How do I get a W9 form online?

Most employers will provide you with a blank W-9 as a part of standard onboarding. Visit the IRS website to download a free W-9 Form from IRS website if you haven't received your form.

The W-9 is an official form furnished by the IRS for employers or other entities to verify the name, address, and tax identification number of an individual receiving income. The information taken from a W-9 form is often used to generate a 1099 tax form, which is required for income tax filing purposes.

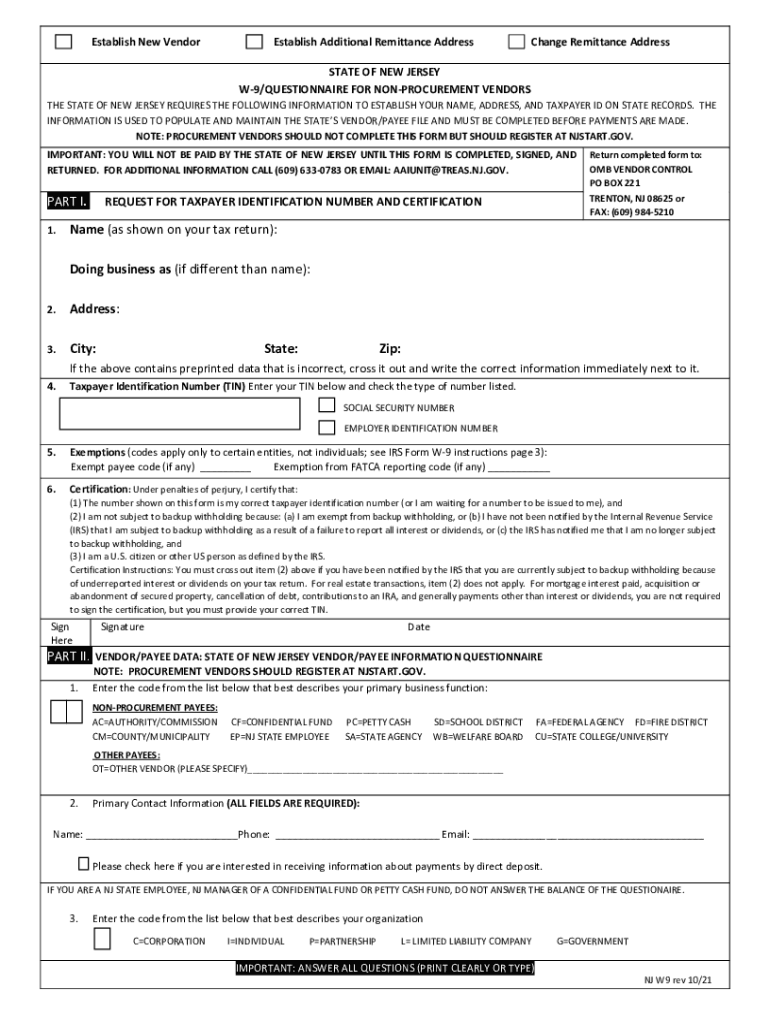

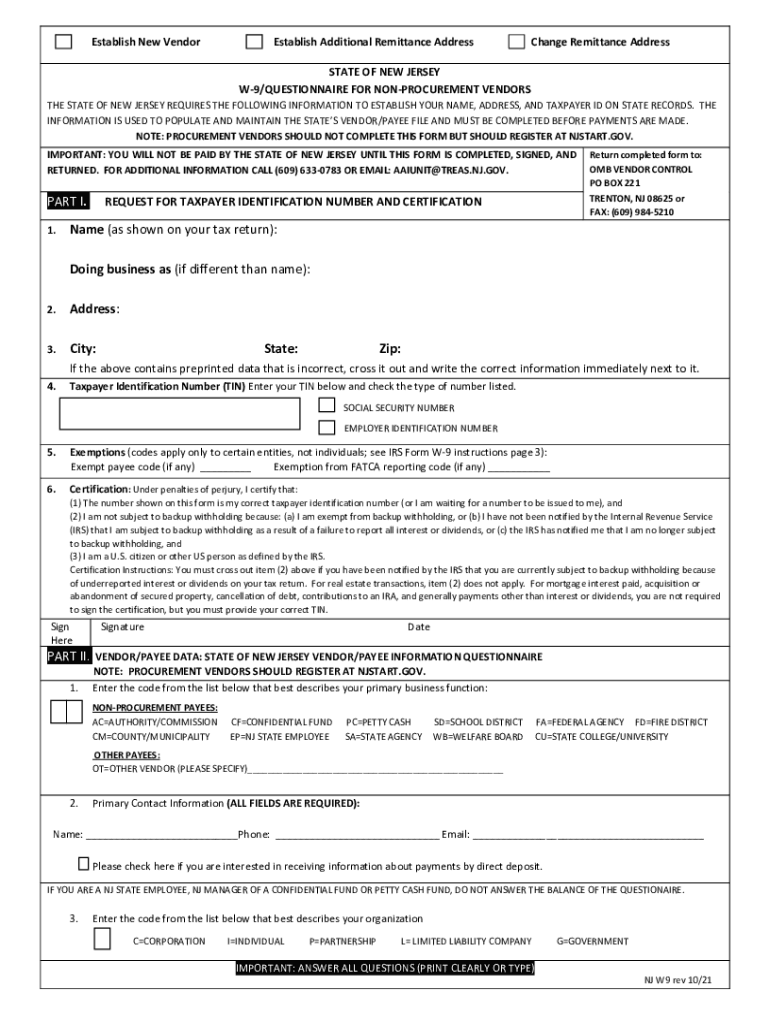

How do I fill out a w9 for a new business?

How to fill out a W9 form Name. Line one requires the full legal name of the taxpayer. Business name. Line two is for a business name. Federal tax classification. Line three indicates the individual or business type. Exemptions. Individuals can skip this section. Address. Account numbers. Tax identification number.

How do you fill out a w9 step by step?

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. Choose your federal tax classification. Choose your exemptions. Enter your street address. Enter the rest of your address. Enter your requester's information.

Do I put my name or company name on w9?

If you are a sole proprietor or single-member limited liability company (LLC), you should enter your own name on line 1 as well. Partnerships, multiple-member LLCs, C corporations, and S corporations should enter the entity's name as shown on the entity's tax return. The second line is for your business's name, if any.

How do I fill out a w9 paper?

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. Choose your federal tax classification. Choose your exemptions. Enter your street address. Enter the rest of your address. Enter your requester's information.